Account Determination

Introduction

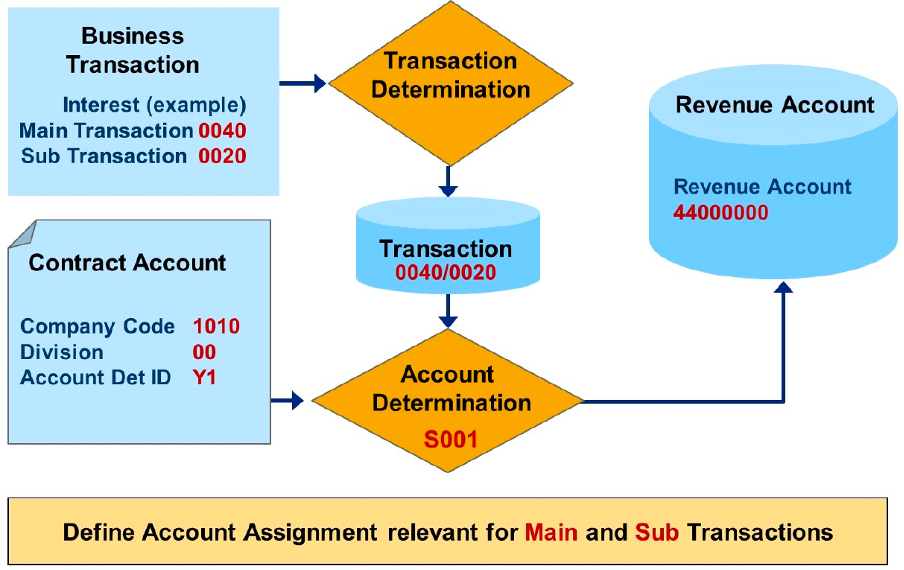

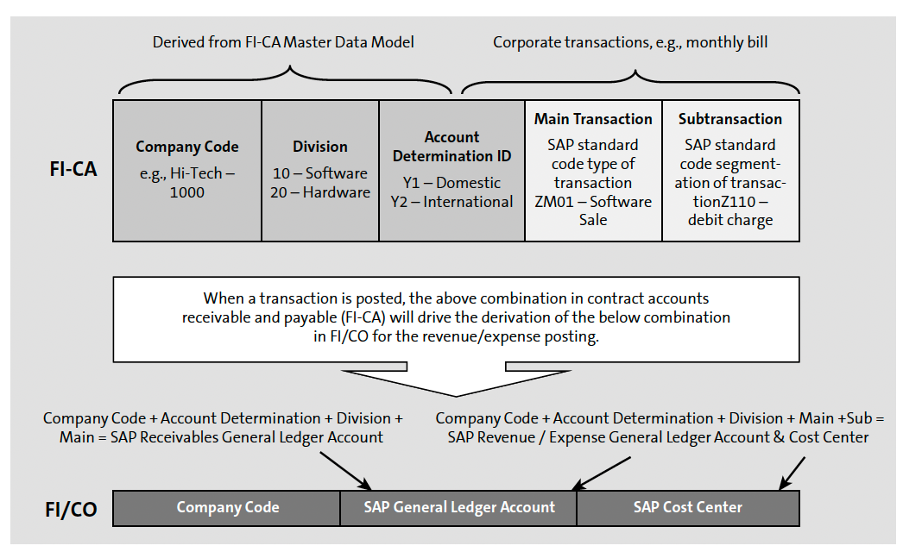

This deals with the “Account Determination” that is used to determine the Main Transaction and Sub transaction – relevant account assignment data. It separate the set of GL’s for Receivable and Revenue Income for each type of customers.

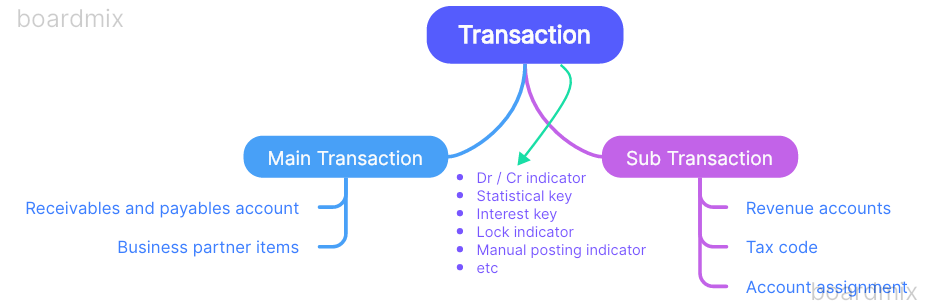

Transaction a combination of main and sub-transactions in SAP FICA.

Transactions:

- Internal Main & Sub Transactions

- Used by defualt in system

- External Main & Sub Transactions

- Used in parameterization table & can be renamed by customer

- Combination of a main transaction and a sub transaction.

- The description explains the business transaction and is available in all correspondence.

- The main transaction controls the determination of the receivables and payables accounts.

- The sub transaction controls the determination of the revenue accounts and the tax code.

- The sub transaction controls the determination of additional account assignments as well (business area, CO accounting).

The determination of receivables accounts which are to be posted depends on,

- Company codes,

- Division (Gas/ Power/ Water),

- Account determination ID and

- Main transaction.

- GL Account.

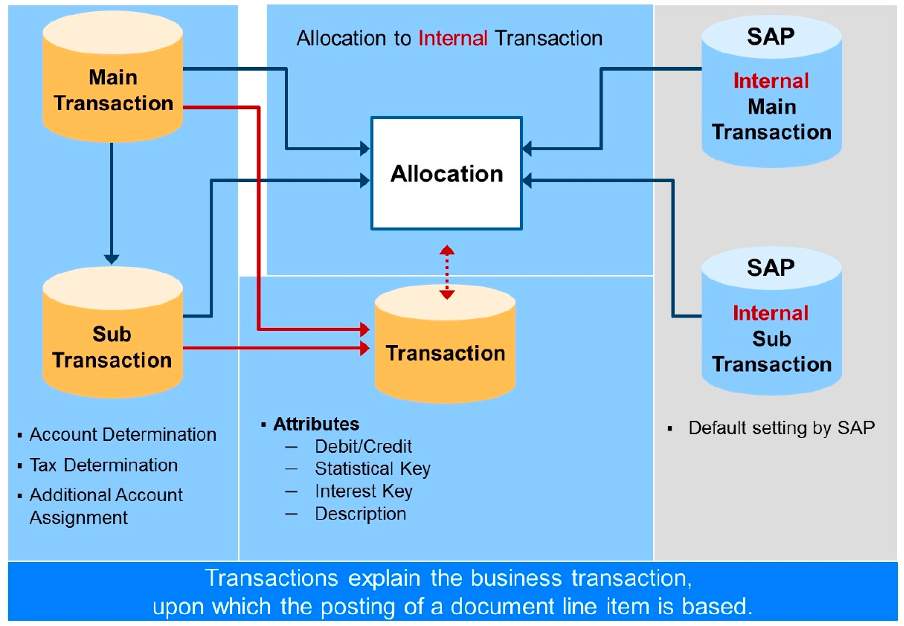

Internal transactions are those transactions that take place in FI-CA and its industry-specific versions. The main examples of these transactions are charges, interests, clarifications and payments.

The allocated external main and sub transactions provide the parameters needed to post these internal transactions.

You have to assign each internal main and sub transaction to an external transaction, even if you have decided not to rename the transactions. In this case, you have to make identical entries in the fields for external assignment. You should not delete internal main and sub transactions as they are fixed in SAP programs.

Main and sub transactions:

- identify items based on their type (charge, interest)

- process from which they originated (payment, account statement).

- 1 main transaction have multiple sub transactions.

This function links each item to a main transaction to which multiple sub transactions are assigned. For example, there is a main transaction Charge with assigned sub transactions Dunning Charge, Return Charge and Installment Plan Charge.

All postings in FI-CA contain information about the underlying main and sub transactions.

You can define new entries in this table for use in transactions not defined as internal to FI-CA. These additional transactions are used in general ledger account determination.

You can assign additional attributes to the new transactions. These attributes are copied to the business partner item when the posting is made and influence the business transaction:

- Description of line item in the account balance display

- Manual posting indicator

- Debit/credit indicator

- Payment lock

- Interest lock

- Dunning lock

- Dunning procedure

You can use posting areas 1090 and 1091 to use the original clearing reason to determine the transactions, if documents that do not have any business partner items (payments) are cleared themselves (by reversal or clearing reset). In this case, the system automatically creates a business partner item to which the clearing information can be written.

You can use posting area 8121 to determine the transactions for Convergent Invoicing (CI) invoicing documents on several characteristics such as billable item type (recurring fee, usage).

You can use posting area 1200 to determine the transactions for Sales & Distribution (SD) invoicing documents on several characteristics such as billing type, item category and account assignment group.

You can specify sub transactions for business processes that are not represented in FI-CA. These sub transactions are allocated to the freely-defined main transactions. This enables you to model infrequent transactions and use them for manual posting.

** In the following cases it is not necessary to allocate external to internal transactions:

- If user-defined transactions like other receivables for manual postings do not correspond to internal transactions (Customer defined).

- Depending on the charge schedule selected in the dunning steps of a dunning procedure, dunning charges are to be posted either statistically or as relevant for the general ledger (1:n allocation).

- Depending on the billable item type, you can derive external main and sub transactions in posting area 8121. So it is possible to allocate different revenue accounts to different revenue origins (recurring fee, usage) in SAP Convergent Invoicing.

Posting Areas

It is a key representing a business function that supports automatic determination of certain data required to create the documents. This data can include account numbers, transactions and other specifications or defaults used in posting and clearing transactions.

In FI-CA, customizing tables are not defined for every posting area. Depending on the posting areas, tables are identified by their key and function fields.

-

transaction FQC0to maintain posting areas. -

transaction FQCRto select account determination data across all posting areas.

The posting area normally consists of different keys.

The system first attempts to determine an entry with the key fields that are used. If this does not work, the last key field is excluded at the next attempt. At the last attempt, only the first key field value is used.

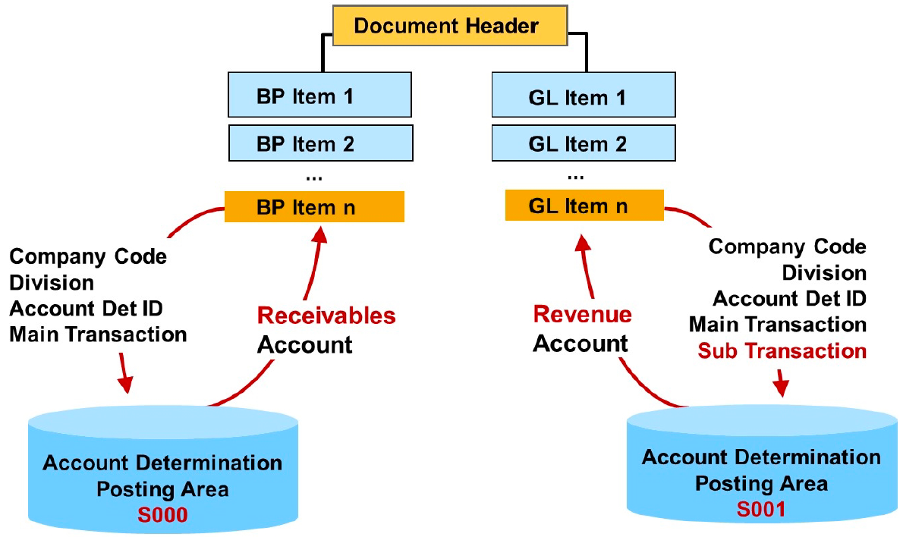

General ledger accounts are determined by standard account determination functionality. This function takes a subset of posting parameters and checks allocation tables in FI-CA: posting area S000 and S001 (posting area R000 and R001 for utilties).

- General ledger account determination is done using main transactions and sub transactions from the line items of postings and additional parameters like company code, division and account determination ID.

- Depending on the industry component used, the account determination ID is derived from either the contract account or from the contract.

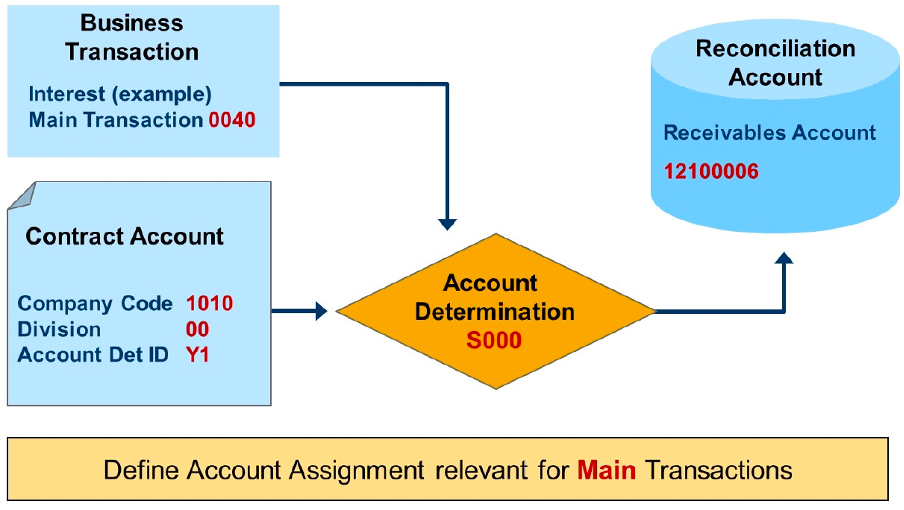

- You can use posting area S000 (R000) and event 1101 to determine the FI-GL receivables account (business partner items).

- You can use posting area S001 (R001) and event 1100 to determine the FI-GL revenue account (general ledger items).

Each individual posting in the FI-CA subledger is allocated to exactly one receivable or payable account in the general ledger. A negative transfer amount is a credit (payable) and a positive amount is a debit (receivable, usual case).

FI-GL Account

The FI-GL account in the business partner item of a FI-CA document (receivable) must be designated with the account type X Balance Sheet Account in transaction FS00.

The FI-GL account in the business partner item of a FI-CA document (receivable) must be designated with the reconciliation account category V Contract Account Receivable as well. This prevents unintentional direct postings to these accounts and thus avoids potential complication of the reconciliation process.

The FI-GL account in the general ledger item of a FI-CA document (revenue) must be designated with the account type P Primary Costs or Revenue in transaction FS00.

The receivables account determination requires only the main transaction which is derived automatically by the system during business transaction processing based on the internal transaction and its allocation to a defined external transaction.

The account determination ID from the contract account enables the derivation of different receivables (and revenues) accounts for different customer groups (private or industry).

The account assignment for main transactions is stored in the posting areas.

- S000 for application area Extended FI-CA

- T000 for application area Telecommunication

- P000 for application area Public Sector

- R000 for application area Utilities

- M000 for application area Media

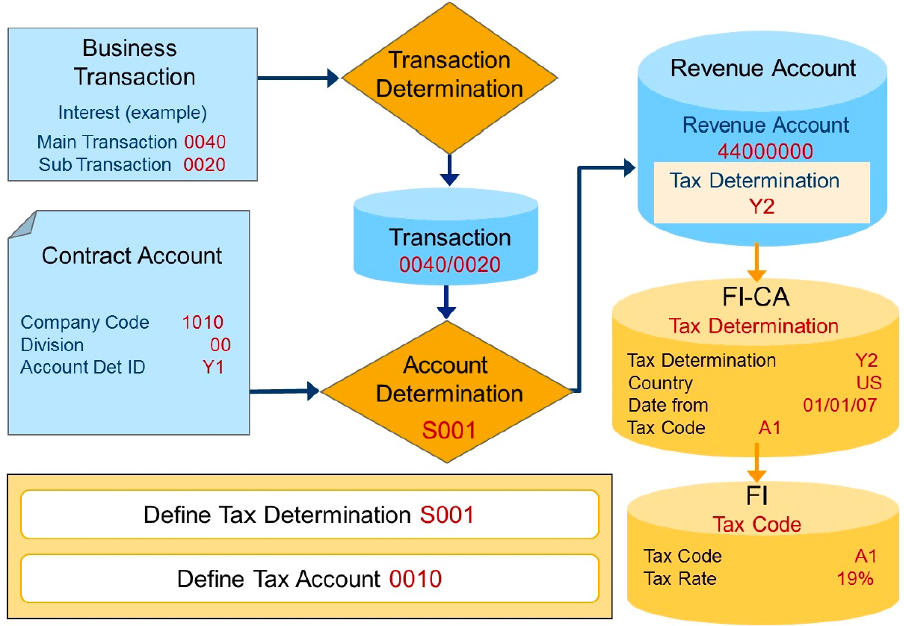

The revenue account determination also requires the sub transaction. This enables you to allocate different revenue accounts to the same business transaction (main transaction). Furthermore, the tax determination code and the CO account assignment key can be allocated as well.

The account assignment for main and sub transactions is stored in the posting areas

- S001 for application area Extended FI-CA

- T001 for application area Telecommunication

- P001 for application area Public Sector

- R001 for application area Utilities

- M001 for application area Media

The account assignment for CO objects can be configured by the following steps:

- In FI-GL account master data, set the Profit Center field as optional.

- In FI-CA customizing, activate the profit center for BP items in the company code settings.

In FI-CA customizing, define the account assignment keys for which you derive CO objects dependent on company code, business area or segment.

Check whether you now need to make the settings for each profit center. This is necessary, for example, if you derive a cost center and a profit center is defined in the cost center. In this case, the profit center in the derived cost center should be the same as the profit center previously copied from a BP item.

Tax Determination

You can use posting area S001 not only for revenue account determination, but also for the derivation of the tax determination code.

You can use posting area S001 not only for revenue account determination, but also for the derivation of the tax determination code.

You can use the tax determination table TE011 to determine the valid tax code for general ledger accounting historically and country-specific based on the tax determination code.

You can use posting area 0010 to specify the tax accounts to be posted depending on company code, tax code and tax transaction.

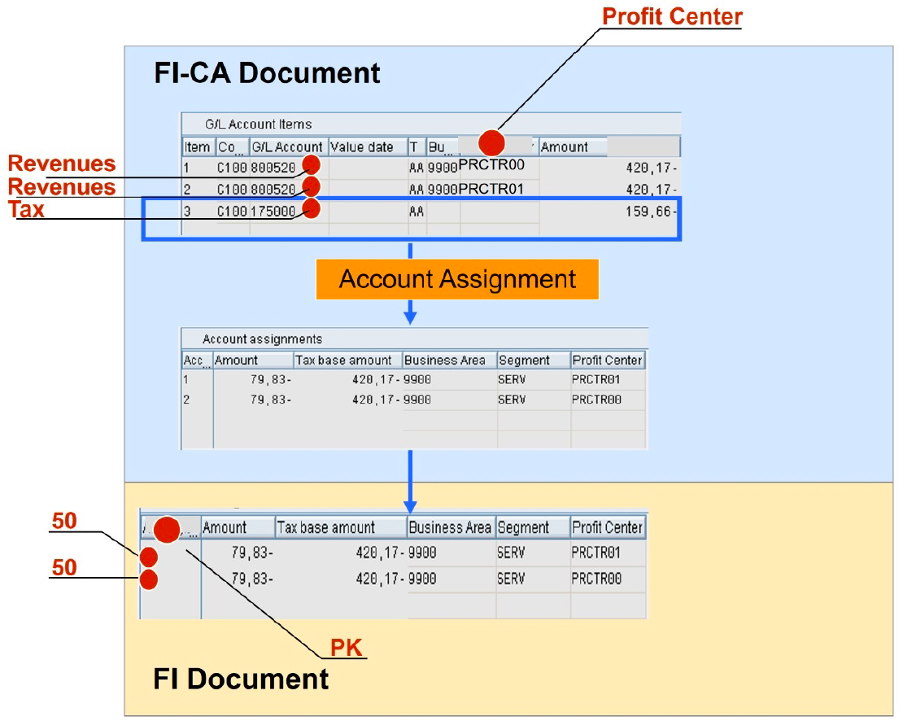

In FI-CA, an enhanced account assignment of postings to accounts for tax on sales and purchases is available. This also includes the option of splitting tax amounts and tax base amounts across different account assignments.

The enhanced account assignment option applies to the following fields: business area, segment, profit center, commitment item, funds center, fund, functional area, funded program and grant.

If you want to use the enhanced account assignment for tax items, you have to activate this option in customizing for each company code. If the new function is active, the system determines, for each tax item, all other related G/L items that have the same tax code. These items can contain various combinations of the account assignments listed above. The system determines the total amount for each combination. The tax item is then mathematically split into subitems and the relevant account assignment combination is assigned to each subitem. The subitems are relevant for updating totals records for the reconciliation key and, therefore, also for updating the general ledger.

In the FI-CA document display, the tax items are initially displayed as usual. If the account assignment is unique, the tax item is displayed in the same way as for other general ledger items. If there are differing account assignments, you can display the split using the Account Assignment button.

Sample Transaction Codes

| Transaction Code | Description |

|---|---|

| FQCR | Account Determination: List |

Sample Perocess Flow

Customizing

Number Range Object

Posting Areas:

| Posting Area | Description |

|---|

0010 | Tax account determination 1090 | Determine Transactions 1091 | Determine Transactions 8121 | Determine transactions for convergent invoicing 1200 | Determine transactions for sales and distribution S000 | General Ledger Account determination - Receivabls (Industry independent) S001 | General Ledger Account determination - Revenues (Industry independent) R000 | General Ledger Account determination - Receivables (Utilities) R001 | General Ledger Account determination - Revenues (Utilities)

Tables

| Table | Description |

|---|---|

| TFK033C | Account determination: Control |

| TFK033C1 | Account determination: Control (F1/F4 Modules) |

| TFK033C2 | Account determination: Control (Check Modules) |

| TFK033C3 | Account determination: Control (Navigation Module) |

| TFK033D | Account determination: Data |

| TFK033E | Account determination: Choice of key used |

| TFK033R | Account determination: Reading sequence |

Authorization Objects

Possible values

Function Modules / BAPI

| Function Module | Description |

|---|---|

| FKK_ACCOUNT_DETERMINE | Kontenfindung: Lesen der Kontenfindungstabellen |

| FKK_ACCOUNT_DETERMINE_XXXX | Account Determination: DUMMY Module for Compiling Where-Used List |

| BAPI | Description |

|---|

Events

| Event | Description | Sample Module |

|---|

Function Groups

| Function Group | Program | Description |

|---|---|---|

| FKC0 | SAPLFKC0 | FI-CA: Customizing |

| FKC1 | SAPLFKC1 | Account Determination |

| FKC3 | SAPLFKC3 | Application modules for acct determination |

| FKC5 | SAPLFKC3 | Application modules for acct determination |

==============================

Updates in progress - Stay Tuned..!!!